Article written by Dr Chris Lavers Principal Scientist at the Dartmouth Centre for Sea Power and Strategy

Space provides critical mission access for naval and maritime tactical communications, missile warning, intelligence, and surveillance. However, many problems limit its use: development and operational costs, long construction time, with space increasingly congested and contested, and hostile satellites threatening those that control everything from communications to security.

The Department of Homeland Security estimates $1.6T of US revenues (2015) derives from satellite activity. Nanosatellites are a potential maritime solution, developed at low cost, quickly and in numbers for threat resilience, but without the capabilities traditional systems provide. With defence budget cuts, dedicated multi-billion dollar satellites appear to be finished, including the US 2009 $12B TSAT program, which signalled a shift from strategic to smaller-scale tactical levels.

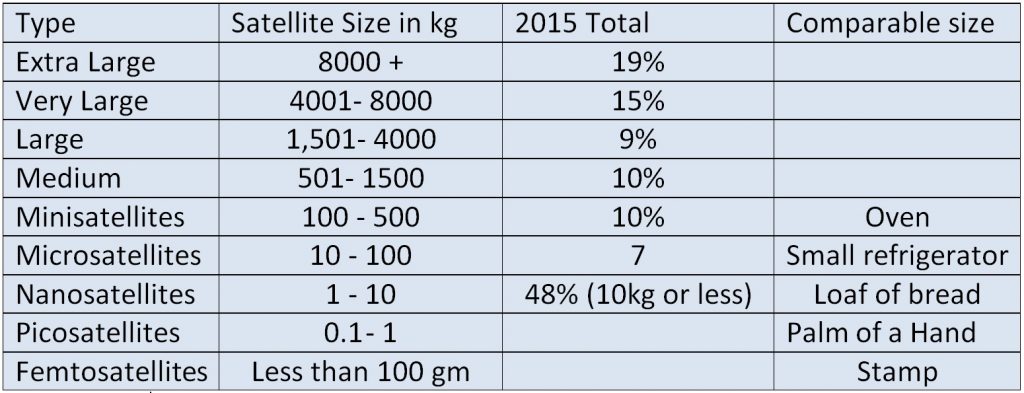

Table 1 Satellite categories. (564 nanosatellites launched by end Nov-2016)

Satellites divide into categories, from the smallest to the largest, and were once only affordable by wealthy nations. Nanosatellites, mostly built by civilian companies, offer emerging countries abilities to deploy spacecraft rapidly from development to launch (Table 1).

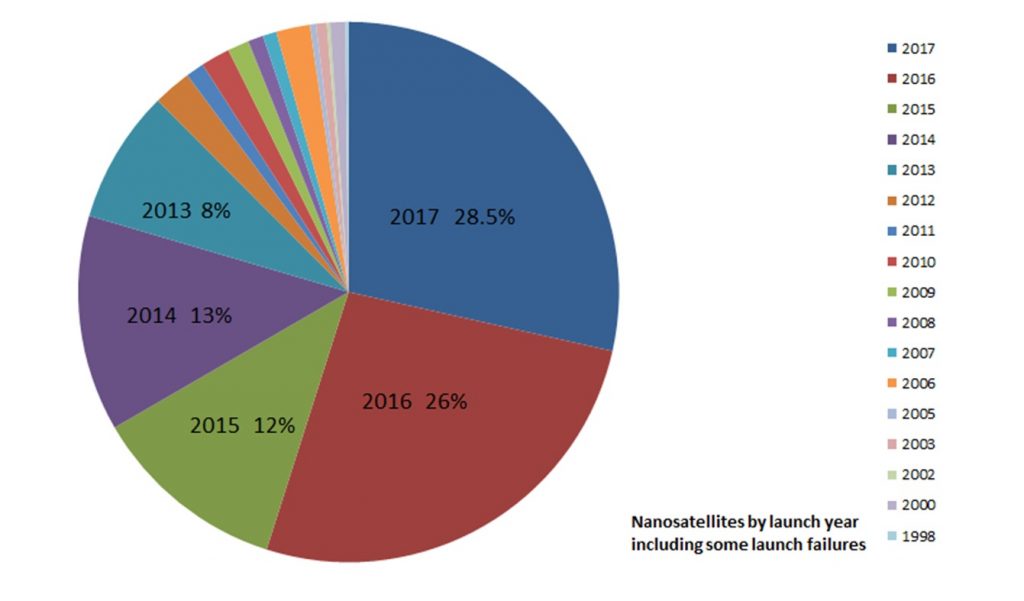

Commercial electronics has driven manufacturing for high volume, low unit cost and reliability, with reduced failure rates, essential for military solutions. Building low-cost, rapid-response and reliable operational nanosatellites for naval forces with cheaper COTS-based imaging and sensing chips will challenge the status quo of space economics for coming decades, typified by Surrey SSTL’s nanosatellite STRaND (2012) which included a smartphone containing accelerometers, magnetometers, GPS receivers, gyroscopes, barometers and cameras, for testing smartphone components in space-environments using loaded Apps. Between 2015-2025 1400+ satellites, including nanosatellites, should launch (figure 1).

Figure 1 Nanosatellite launches planned since 1998.

Reduced launch demands mean that over 60 nations are developing space capabilities arising from Smartphones to perform functions of heavier satellites at reduced cost (CubeSats cost $1M< rather than £200M-1B for full-sized ones). Elon Musk, SpaceX’s CEO predicts costs may fall to only $200k per kilo.

Battlefield advantages

In the naval environment as well as the terrestrial battlefield, visibility of operations in remote regions often lacks over-the-horizon radio communications from field to headquarters. In this regard much naval development is drawing upon more extensive army expertise.

Here the US Army Strategic Command Nanosatellite Program (SNaP) is already helping disadvantaged users with ‘eyes-in-the-sky’ providing voice, data and imagery, with nanosatellites viewed as effectively LEO space-based mobile phone towers, deployed in sufficient numbers to provide wide-area capabilities, easily replaced if destroyed and with reduced reliability requirements.

Nanosatellites complement larger missions, filling gaps such as the war-fighter ground component, currently unsupported by space systems. Another LEO advantage is proximity to the upper atmosphere, permitting monitoring chemicals over battlefields as well as the space-ocean environment.

Constellation proliferated spacecraft will in future support tactical maritime operations and humanitarian efforts, regularly monitoring large-scale disasters, where rapid information is critical to identifying affected areas.

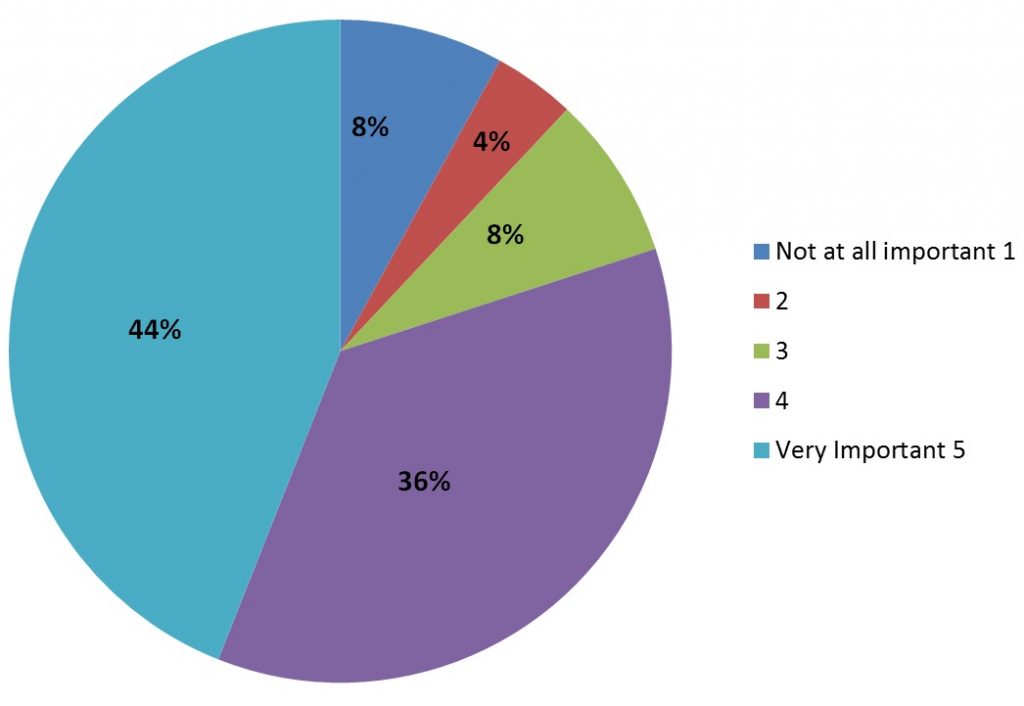

Constellations dedicated to tactical maritime operations benefits C3, providing persistent presence over maritime operations as well as several benefits: graceful degradation (losses don’t end the mission), increased temporal resolution, surveillance or 3D-stereoscopic comparison. Persistency, the ability to maintain continuous target surveillance, is highly regarded, as seen from our research (figure 2).

Figure 2. Persistency value regarded from 24 military and civilian maritime organisations.

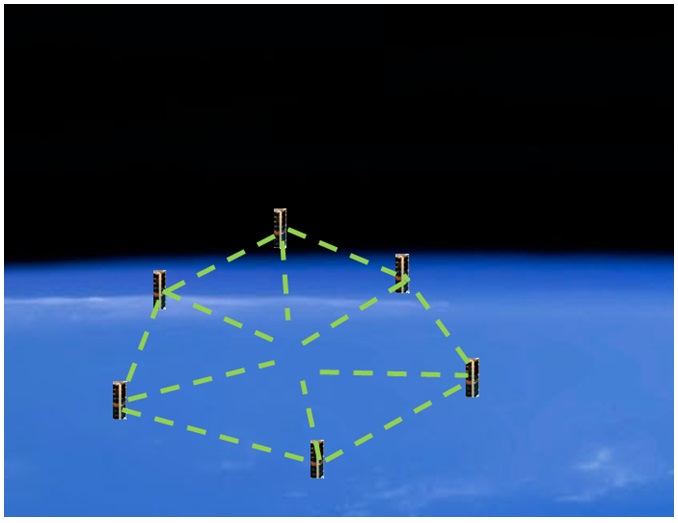

Nanosatellites have limited aperture, but co-operative distributed satellites can provide larger effective apertures (figure 3) with higher resolution and loss resistance, as well as being harder to target than existing maritime drones.

Figure 3 Larger effective aperture (co-operative satellites).

Maritime Security and Tracking are important applications, with 250,000+ ships broadcasting AIS, allowing terrestrial detection up to 50km. One San Francisco company Nano Satisfi is looking at LEO nanosatellite fleets to provide vessel positions without costly uplinks (latest swarm launched 23/04/2016).

Companies like FleetMon, are interested in reducing satellite AIS costs, but want data quality matching terrestrial AIS. Similarly RF geolocation companies like US HawkEye360 (providing government maritime domain awareness), have their first satellite scheduled for 4Q201. The Danish Defence Centre’s military response is typical, wanting nanosatellite AIS, ADS-B, and 24/7 low data-rate communications payloads, or the UAE requiring pirate and illegal shipping detection imagery.

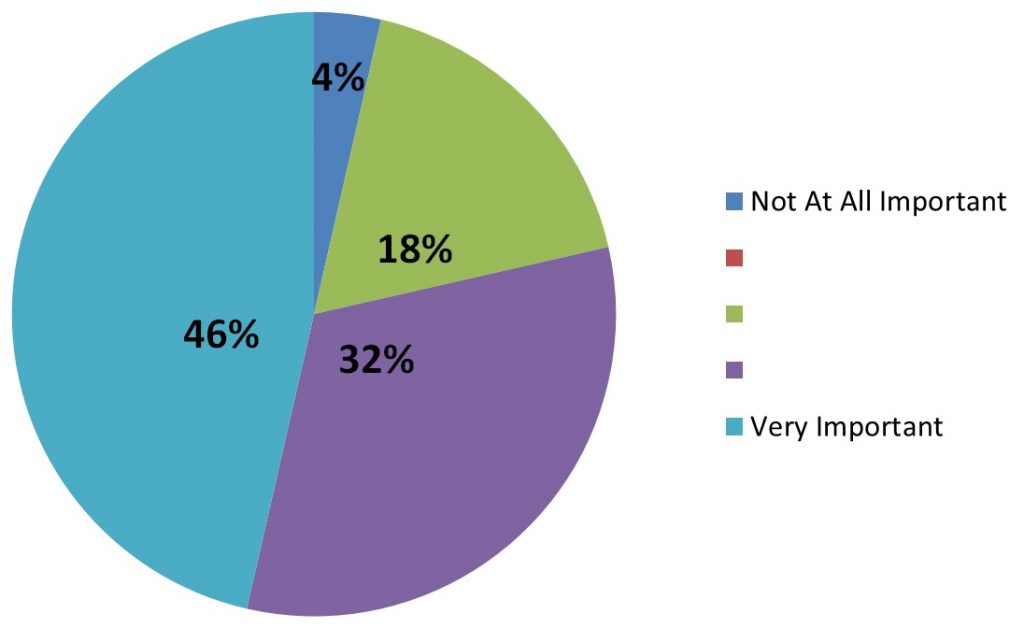

The importance generally given to 24/7/365 capability and All Day Night capability can be seen in figure 4, compiled from 28 naval and aerospace supplier responses.

Figure 4. All day and night value regarded from 28 military and civilian maritime organisations.

Key Players

In military terms the US Army’s SMDC has been at the forefront of nanosatellite development, focused on tactical nanosatellites to serve as battlefield BLOS nodes for war-fighter communications. The SMDC Operational Nanosatellite Effect (SMDC-ONE) program is developing satellites for LEO tactical communications, essential if other links are unavailable, exchanging data from ground terrestrial and amphibious command segments, via satellites to war-fighters.

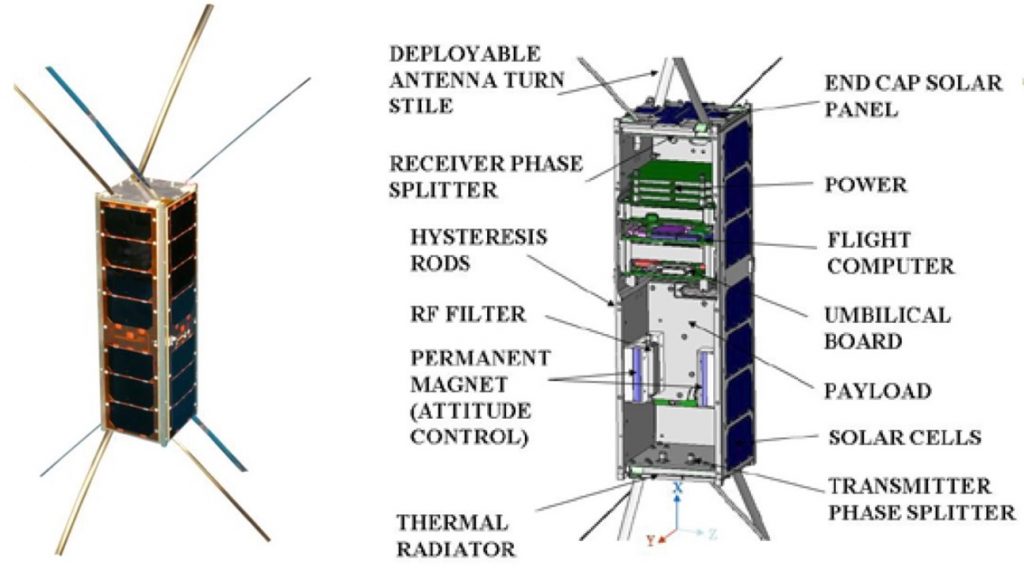

Eight 4kg SMDC-One nanosatellites were ordered from Miltec Corp, costing c.£350k with the first launched on a Falcon-9 rocket (4Q2010). SMDC was the first Army-built satellite in 50 years since Courier 1B, and sets the benchmark for maritime and amphibious force developments. LEO orbits bringing nanosatellites 60 times nearer Earth than GEO, relaying weak signals from hand-held radios to provide persistent coverage as GPS is on hand-held devices today.

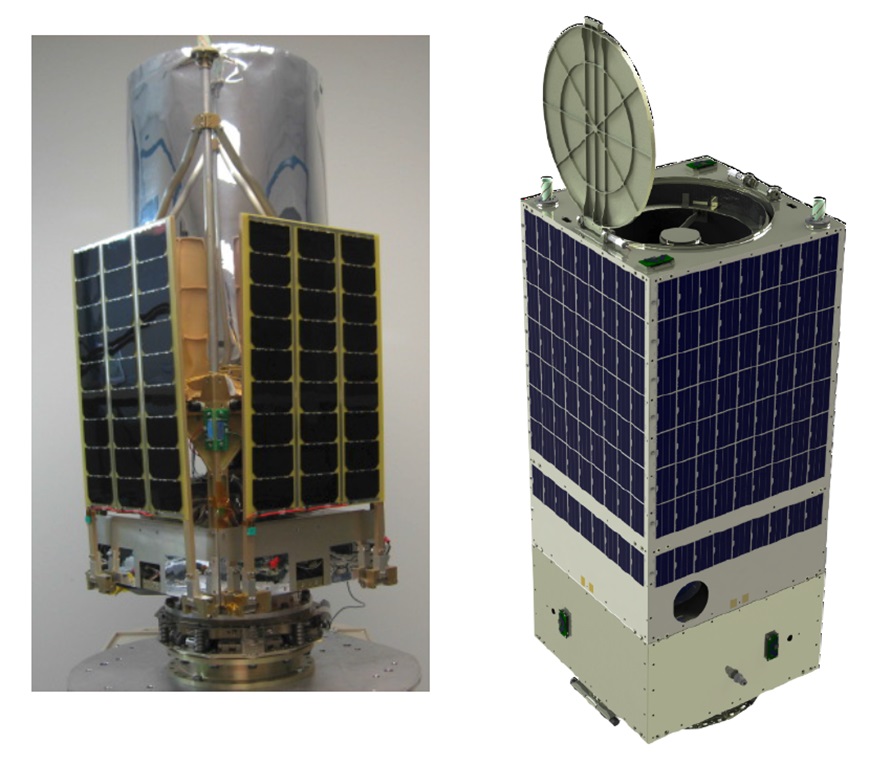

Figure 5 SMDC-ONE

SMDC-ONE (figure 5) provided 2-3m ground resolution, sufficient to identify tanks, from task to soldier within a minute, from a Command and Control (C2) station, or data exfiltration from unattended sensor buoys to other stations. The test network included concealed seismic and passive IR sensors feeding the ground station, detected within a 1200 mile LEO footprint, but could as easily incorporate floating sensor buoys. Other objectives included real-time voice and text messaging between forward-deployed tactical UHF radios and year-long operational life (35 days before burning-up), with SNaP-3 the most recent (08/10/2015).

The US Army is looking to higher capacity third generation (UHF and Ka-bands) systems: Kestrel-Eye (strictly at 14kg it isn’t a nanosatellite), NanoEye and Small Agile Tactical Spacecraft (SATS) to provide generational capabilities improvements. Numerous Kestrel-Eyes will demonstrate battlefield persistent electro-optical near nanosatellite-class imagery (1.5m) over year-long operations, within 10 minute-tasking windows.

Figure 6 Kestrel-Eye © Maryland Aerospace Inc.

Maryland Aerospace Inc., (founded 2002), is building Kestrel-Eye Block II (figure 6) for the US Army, with first launch planned for 2017 (Falcon-9). NanoEye will cost $1.4M each, less than traditional DoD programs, whilst SATS will provide 1.5-2m ground resolution over a 3-year lifetime with 3 operational modes: Point and shoot –multiple imagery per pass, Scene -still images or video along pre-planned paths, or 5M pixel images (4 frames s-1) with 50% stereoscopic overlap. The US Coastguard already provides Arctic situational awareness, safety and security in all-weather conditions with limited aircraft and vessels. Project Polar Scout is their demonstrator for mixed-government and commercial nanosatellite provision to locate emergency beacons used by mariners in distress.

Raytheon Missile Systems is adapting manufacture to mass produce nanosatellites below $500k, downlinking imagery to tactical users, alongside the SeeMe satellite (60-90 day lifetime), and DARPA’s Dec. 2016 $1.5M award for 24 satellites with colour cameras. With reconnaissance applications in mind Skybox already captures high-resolution imagery (90cm) whilst Planet provides 3-5m resolution, updated hourly for vehicle analysis or monitoring critical infrastructure, and timed-series (e.g. monitoring Chinese Spratley Islands’ construction).

Other companies like Aquila Space have demonstrated optical and radar satellites (6kg) comparable with Planet (3kg). In 2016 India’s PolarSat ocean mapping satellite launch carried 12 Planet Dove satellites, Planet, a US Earth-imaging company, can produce 100 in 18 months at low cost, to less stringent standards and 2-year LEO lifetimes, before re-entering the atmosphere.

Restricted technology access and developing countries financial limits prevented them getting cheap and efficient space services. Now there are many developing country programs: India, Iran, China, South Africa, Vietnam etc. India’s Jugnu 3kg disaster monitoring nanosatellite, developed for 25M rupees and year-long operation (2011) was followed by PISat (5.3kg) a 80m resolution camera launched 09/2016, and now Cartosat-2’s delivery of a record breaking 104 nanosatellites (15-02-2017).

China’s space ambitions are clear, pursuing a growing commercial and military agenda. Its program is founded on pursuit of PLA military advantage to exercise space denial and LEO dominance. Since the 1990s China accessed US space technology, space corporations and government institutions, presenting competitive risks to the US. China can now develop secure constellations and replace satellites, exploiting technology to strengthen its space and military nanosatellite sectors including maritime security and naval dominance, investing in Harbin Institute of Technology, Nanjing University of Aeronautics and Aerospace, and the National University of Defense Technology aerospace.

Luliang 1 in 2015 was one of 20 satellites launched on the CS-6 rocket’s maiden flight, intended for space-based AIS reception and aviation Automatic Dependent Surveillance Broadcast (ADS-B) detection. Singapore’s 2014 key development was nanosatellite and picosatellite separation for inter-satellite communications over a 2-year lifetime (VELOX-1 3.5kg and VELOX-P3 1.5kg) launched 30/06/2014 and still operational.

Japan has strong university-based nanosatellite development, between 2003-2012 they produced 17, leading to the ‘Hodoyoshi-project’ for reliability nano/pico-satellites concepts including Miniature Ion-Propulsion Systems to provide large thrust for low power.

Russia’s plans are unclear, but sparked a revolution with the first 3D-printed Cubesat, Tomsk TPU-120 launched to the ISS (2016). According to RAI Novosti “This is the first 3D-printed space probe built. Further advancement of this technology will enable mass-scale production of small satellites.” Most of its components are plastic reducing weight substantially. Other printed satellites include Printsat-SLS (launch failed in 2015) and RAMSES (Rapid Manufacture of Space Exposed Structures) SLS Part of QB50 launch planned 16/03/2017 (Cape Canaveral SLC-40).

The UK Government has invested £1.2B between 2010-15, with 2015 a record for start-up ventures investment. Having just delivered a programme to UK MOD, ESA awarded Roke Manor Research a contract to SysNova, a nanosatellite technologies initiative. Clyde Space, with its historic maritime links, has secured a contract with Canadian Kepler for manufacture of 2 software defined radio communications nanosatellites.

The Israeli Nanosatellite Association launched its first nanosatellite in June 2014, Duchifat 1 (official goal a space studies educational platform), and a SAR network for distress signals in areas isolated from communications infrastructure. Israel is a recognised nanotechnology leader and will launch more (besides BGUSAT and Space Pharma on ISRO). Developing military nanosatellites is the IMoD’s responsibility, with civil applications including agriculture, earthquakes and water issues.

Even small countries like UAE (Nayif-1 on ISRO) and Lithuania have developed nanosatellites: LitSat-1 (3kg) and Lituanica Sat-1, launched from the ISS (February 2014), to test on-board systems and earth-satellite communications with a GPS receiver to detect maritime signals in the Adriatic.

The ISS platform can release satellites to lower orbits, deploying 49 satellites in 2015. Considering launch rates collision are a concern; between November-2013 and January-2014 71 nanosatellites were sent successfully into space. However, not all missions succeed, in April 2014 a SpaceX ISS resupply mission to place 104 crowd-funded ‘Sprites’ into orbit (the size of a stamp containing radio, aerials, solar cell and instruments), developed a fault so they weren’t released and burned up on re-entry.

Launchers

Launch availability is a severe bottleneck, there are few dedicated launchers, with excessive reliance on ‘piggyback’ launches. Nanosatellites whether for naval or army applications provide increased freedom, moving from hitching rocket lifts, potentially to aircraft, balloons and more efficient rocket launches (less capital and reduced risks). DARPA is working on technologies to reduce weight, improve optical surveillance reliability, exploring chemical/electrical propulsion, advanced structures, additive layer technologies, and miniature RF for radio and sensing.

Although currently propulsion-less, tiny engine design would allow nanosatellites to remain in space longer, or drive them to ‘burn-up’ on mission completion, using magnetic field accelerated ionised propellants or mixed water-alcohol propulsion systems. Given DARPA’s cancellation of its Airborne Launch Assist Space Access (ALASA), after 2 ground-test explosions of NA-7 monopropellant, NASA offered the 2015 Centennial challenge, a £3M prize to launch 1kg+ satellites, delivered to orbit twice weekly.

The US Army backs SWORDS, a nanosat launcher built from retired artillery rockets for $1M/flight, whilst the CRD Research Corporation is pioneering low-cost reusable launches with two-stage orbit insertion, composed of a MENACE vehicle with boost, based on their MLRS firing experience. MENACE can deploy far from launch sites with vehicle fly-back (accelerating to Mach 5.0 at 100,000 feet), whilst Pumpkin supplies military nanosat parts, including the US National Reconnaissance Office’s 12 CubeSats ($400k each) to monitor space weather, critical to US space warfare for military as well as civilian maritime applications. Future commercial launches may be provided by Virgin Galactic’s Launcher One, Pegasus, or Orbital ATK.

Capability Limitations

Power- Accessible power for a 10kg satellite is under 18W which limits ground range, requiring low LEO orbits. Another restriction is processing power, which benefits to an extent from mobile phone technology. CubeSat data-buses use the limited I2C de facto COTS standard: 400kHz clock speed, and 200.6kbit/s bit-rate.

Capability gaps exist, such as low-cost inter-satellite data-exchange links (optical or RF) to MILSTAR GEO-SATCOM, and small antenna gains. Laser Communications may provide higher performance and efficiency above traditional RF, providing 6 times RF data-rates (600 vs 100Mb/s at Ka-band), potentially supporting war-fighter video feeds rather than pictures. Although RF is the backbone of space-based operations, lasers may provide higher data-rates, halving mass and requiring less power, first tested with the Lunar Laser Communications Demonstration in 2013.

Low-cost nanosatellites sacrifice long lifetimes for 1-2 year design expectancy and reliability, they don’t require redundancy for long-life, nor survive harsh space-weather, as they can be rapidly repopulated. Nanosatellites have short low-cost cycles and can exfiltrate data from enemy territory to embedded war-fighters.

Nanosatellite constellations provide persistence and resilience, and are the most rapidly changing space sector. It is anticipated 2017-2024 will change as much as the last 50 years with a new international nanosatellite space-race, driven by revolutionary and adaptable electronics technologies and new innovative launch providers for both military and civilian maritime S-AIS and imaging applications, well underway.

Further discussion of tomorrow’s military nanosatellites can be found at:

http://www.monch.com/mpg/news/17-space/1261-nano-sat.html