Author Dr Chris Lavers, Subject Matter Expert (Radar and Telecommunications) and Senior Lecturer BRNC, Dartmouth, UK since 1997. He has published some 200 sensing papers and articles, including 5 books in the Reeds Marine Engineering and Technology Series.

Military requirements for highly detailed satellite imagery globally, and available 24/7/365 has driven satellite data providers to reassess the ways in which they conduct their business. Although optical sensors provide satellite imagery with typically 10 centimetre resolution, often from multispectral or narrowband hyperspectral optical systems, they are still limited to hours of daylight, and are further restricted by poor weather, smoke and other battlefield obscurants.

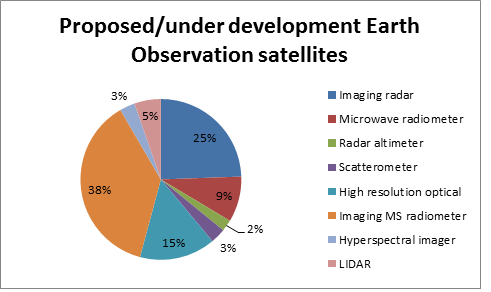

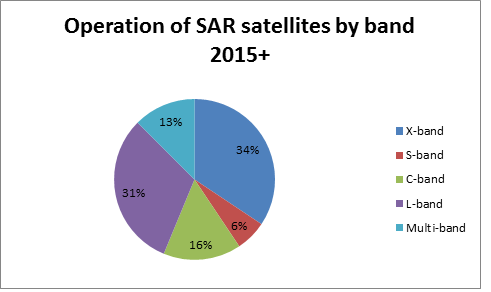

The primary preferred military solution is imaging radar, which is able to operate under the cover of darkness and in challenging battlefield and environmental conditions. The commercial military market is significant, yet the potential for civilian exploitation is even larger, with governmental and pan-governmental users (e.g. the EU’s Copernicus programme) looking to provide detailed large-area views rapidly to end users. Currently there are over 30 proposed satellite radar sensors, many of which will be realised in the coming decade (fig 1).

Imaging radar, or more precisely Synthetic Aperture Radar (SAR) creates 2 or 3-D images of ships, vehicles, and aircraft. SAR systems are often mounted on moving platforms such as aircraft or satellites, and originates from SLAR in the 1950s. Current drivers look to provide increasing improvements in decreased resolution and component size, with demand for foliage penetration, improved strip, scan and spotlight mode, and rapid data products for intelligence acquisitions in battlefield reconnaissance and weapon delivery. To create SAR images successive transmitted pulses of microwave energy illuminate the target, and the corresponding echo sequences are recorded in frequency, amplitude and phase. Using single-beam forming antenna, and wavelengths between 3 mm to 1 m current airborne systems provide resolution typically 10 cm, whilst ultra-wideband systems provide resolution of only a few mm. Effectively the synthetic aperture size is the numerical product of platform velocity and integration period, and as such can be hundreds of metres for space-based SAR radar. There are two SAR options:

- SAR employing Active Electronically Scanned Array (AESA) Transmit-Receive Modules (TRM), and

- Conventional reflector based antenna, e.g. the German Defence SAR-Lupe (launched 2006). The AESA advantage is electronic beam steering, whilst reflector antenna are generally lighter and inexpensive.

Market Size and Key Players

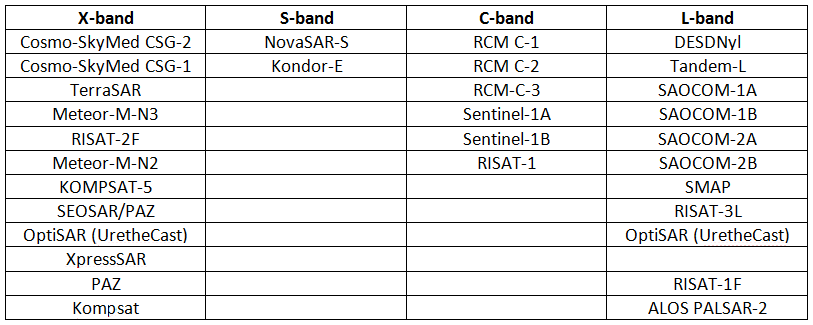

A summary of the current commercial SAR providers is given in Table 1.

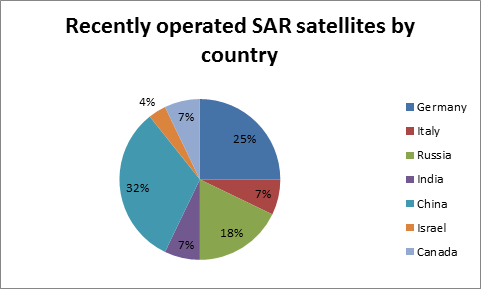

A good SAR constellation data provision model is found in Cosmo-SkyMed, which has already provided over 1 million images, and is composed of 4 identical SAR X-band satellites. Funded by the Italian Space Agency, Ministries of Defence and Education, and Universities (first launch 2007), it now looks to second generation launches (2018, 2019), partnering with Thales Alenia Space Italia (Thales/Leonardo), and Telespazio’s ground system, ensuring delivery to end military users, and civilian monitoring: environmental, civil protection, gas and oil).

The Radarsat Constellation mission, scheduled for launch in 2018, is a Canadian government system run by UrtheCast, Vancouver. Canada already has two MBDA-built SAR, Radarsat 1 and 2, and plans a further constellation of 8, 4 will be in sun-synchronous orbits, and 4 in Medium inclination orbits (2020 – 2021). New York Ursa Space, based in Virginia, plans to launch XpressSAR shortly, part of its own constellation with 30 m resolution down to sub-metric. World Radio Communication Conference permission to allocate new X-band bandwidths, doubled to 1200 MHz, will improve image resolution quality.

Capella Space in Palo Alto recently announced $12M funding to develop smaller, cheaper SAR satellites. Payam Bonazadeh, Capella’s co-founded said, “We’re going after hourly images of anywhere on Earth.” Each satellite will weigh just 100 pounds, providing black and white 1 m resolution from 36 satellites over the next 4 years, with first launch planned some time in 2018 (originally planned launch 4Q.2017). This ambitious statement could be dismissed except for the fact the Defence Innovation Unit Experimental (DIUx) in Pentagon’s Silicon Valley, looking for ‘patterns of life’- early warning indicators of things they need to know about such as spotting North Korean missiles prior to launch- is funding. Non-governmental organisations like Planet have previously monitored North Korea, today operate 190 satellites. In March 2017 DIUx invested in Capella Space and also in new purpose-built launch vehicles to deliver smaller payloads at reduced cost. Inverse SAR (InSAR) data detected the 2016 Korean nuclear test in only 40 minutes. Tre Altamira and IDS GeoRadar’s InSAR satellite routinely monitors large-scale mining operations over hundreds of km2 for earth deformations for long-term risk mitigation. Sentinel-1a data for the 6 Jan 2017 Korean blast monitored vertical movements of just 7 cm. South Korean KOMPSAT-5, launching later this year, will monitor future North Korean tests. Funding for Capella follows on from a January 2007 Congressional Budget Office Report, “Alternatives for Military Space Radar” which examined different satellite constellations and apertures, estimating program cost at that time between 26 – 94 $B! It concluded to have 95% probability of locating mobile missile launchers, the Space Radar constellation would require 35 – 50 satellites. Unsurprisingly given this scenario the radar program was cancelled by the DoD (2008).

High resolution terrain surveillance is very good. If a vehicle drives across a dirt track at night the ground will be compacted 1 – 2 mm, so that the vehicle’s path will be easily seen with SAR, and can detect changes due to water, mineral, oil or gas extraction. China has also entered the strategic SAR market with Gaofen 3, a 3 tonne C-band SAR officially for natural disaster monitoring, and part of the Chinese High-resolution Electro Optical System (CHEOS) network providing near real-time data to government agencies with 12 imaging modes and 1m resolution. China’s Yaogan series of advanced SAR provides multi wavelength, overlapping, medium resolution global imaging of targets. Israel’s 2008 $200 M 300 kg X-band TecSAR provided a major leap for the Israeli Defence Forces and its operational development, whilst a recent South African Kondor-E Kazakhstan launch, also likely provides SAR surveillance. Northrop Grumman wants to license a TecSAR-derived satellite, Trinidad, under new US regulations, licensed for commercial 1 m sales.

Maritime Applications

Lockheed Martin developed the first operational L-band Seasat SAR, revolutionising reconnaissance imaging. Seasat demonstrated a wide-range of maritime applications: coastal phenomena, bathymetry, ships, and their wakes, providing 25 m resolution imagery of Arctic ice and eddies for the first time.

Open-ocean surveillance of ship targets today plays a vital role in fishing and transportation management, and security. Today’s monitoring still largely depends on Coastguard vessels and aircraft, both traditional methods, expensive and limited by search areas, time and weather constraints. Satellite SAR offers a new tool for all-day/night use with high resolution. Algorithms for surface ship detection are being developed, responding to rapid growth in demand, to which Capella’s planned constellation, (for monitoring of ports, oil-storage depots and cities), if successful, will play a significant role.

Future Applications

One of several space-based SAR systems, currently proposed is the Finish Iceye small sat constellation, intended for Arctic ice monitoring- a spin-out project between Aalto University and Stanford, (founded 2012), recognised for their Cubesat developments. Iceye launched their first SAR microsatellite on India’s PSLV-C40 rocket, sending their first ever 100 kg SAR satellite into orbit and establishing Finland’s first commercial satellite operations. They are looking at a 6-8 satellite swarm for applications such as land use, ocean spill monitoring, sub-surface archaeology and mine detection. The explosion in nanosatellite and microsatellite exploitation of near-earth space was recently covered online by Monsch (01 06 2017). Lightweight SAR satellite formations with geo-location, advances in communications micro-propulsion and advanced batteries, and faster processing power will become increasingly important.

Manufacturers:

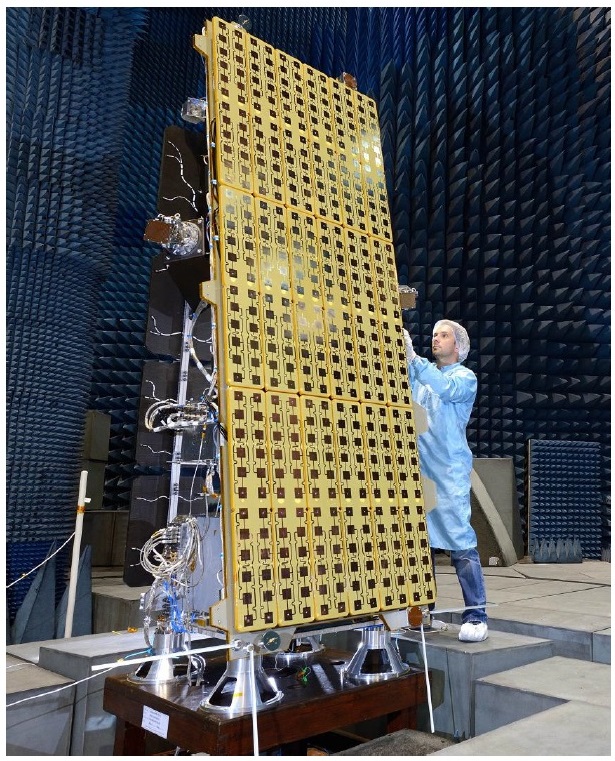

Missions are highly specific but from discussions with members of the Airbus DS team generic issues are noted. Airbus DS tends to operate in response to user requirements rather than developing its own mission planning- developmental risk costs often prohibit such an approach. Airbus DS has much experience in system design, active microwave power modules, electronic and mechanical scanning components and service segments, but less so in Satellite AIS (S-AIS) and RF geo-location (fig 2).

Whilst TerraSAR-X (9.65 GHz) and TanDEM-X are current missions, HRWS and WorldSAR are next-generation missions. Current generation missions can provide metric to 40 m resolution, whereas next generation systems will provide 0.25 m resolution with maritime signal detection modes and larger swaths. TerraSAR, (began 2007), whilst TanDEM (started 2010, both extending to 2022). HRWS will start 2022 with a planned 10-year lifetime.

Airbus missions currently produce, approx. 90 GB/day, rising to 200 – 300 GB for next generation satellites. The size of space-based SAR will rise from 1.4 tonnes to 2 tonnes for next-generation system, requiring hundreds of transmitters. To their customers SAR provides commercial monitoring services for industry, defence and government. Most manufacturers now use both COTS systems, and their own development of GaAs, GaN, and SiGe modules, and solid-state recorders.

It is important to both manufacturers and customers to provide night and day, all-weather, multi-mode capabilities, but persistency less so.

Night and Day/All-Weather: key features for reliable long term and short-term monitoring are considered to guarantee access.

Multi-mode: these serve a range of customer requirements through different imaging and service modes e.g. near real-time, interferometry, geo-location, and multiple bands (fig 3.)

Persistency: this is still valued- with regular revisit and long-term data available continually (incl. follow-on missions and inter-operable system collaboration.)

Most countries and companies see their long-term ambitions to achieve successful commercialisation of space-based SAR and depend upon the provision of very high resolution SAR data with constellation partnership (fig 4.).

Other sources emphasise defence, security (land and maritime), wide area- surveillance, satellite and airborne. Further discussions with Leonardo, manufacturer of the successful maritime Osprey SAR system, highlighted difficulties in adapting aviation or UAV SAR systems for space-based applications, notably in size and weight restrictions.

ASE, spacecraft and SAR instrument manufacturer, successfully launched PAZ in 2008, project ending 4Q.2017. PAZ provides data for governmental imagery applications, intelligence, natural disasters, as well as S-AIS (X-band downlink 300 Mbit/s). PAZ weighs a modest 140 kg providing high data rates approaching 1 TB/day with S and X-bands, 400 – 700W power depending on mode, costing over 100 M Euros with over 50 people working on the mission. PAZ used GaN TRMs 1200 MHz bandwidth, current resolution >1m but next-generation PAZ 2 will benefit the scientific community and Spanish national observational capabilities, providing 0.25 m resolution.

There are obvious SARsat vulnerabilities in the event of space-based warfare, especially for American satellites and not just SAR systems. Russia and China will certainly try to ‘kill’ them, in spite of the fact China is increasingly satellite dependent, with expanding regional and global satellite navigation system, ocean monitoring, SAR and improved communications and remote sensing satellites. Gaofen-3, a SAR system launched on a Long March 4C rocket, as are the Russian Kondor series (Kondor-E for export saw South Africa get its first SAR 4Q.2014). Russia recently requested Astrium to provide a TerraSAR-X and Tan DEM-X like system for $493 M, ten times the cost of the UK’s SSTL/Astrium NovaSAR-S, a £45 M system incorporating mobile phone-related technology.

NISAR a joint project between NASA-ISRO providing L and S-band polarimetric SAR from 2020, to which Airbus Defence and Space recently won a contract to provide the solid-state recorder, (fig 5.). Whilst other countries like Australia are currently looking to evaluate SAR to fill capabilities gaps with options from buying SAR, part-ownership with other nations to having their own civil/military SAR, or stand-alone civil SAR (unlikely in the short to medium-term), building on current Airborne SAR capabilities (INGARA). Space radar generates lots of raw data. Because the algorithms needed to turn this into useable intelligence are complex, most data processing is performed on the ground rather than on the satellite.

SUMMARY

There are clear trends towards Smart Data Analytics, mixing optical and SAR data, providing ‘tailored’ customer specific products, rather than imagery, improving utility of SAR and Earth observation data, resolution and reduced power modes, with smaller systems. There are challenges ahead in getting both mission and imagery costs down. There are also increased demand for persistency with high-resolution combined. Software-based multi-polarisation, frequency and multi-modes will increase. Synchronised fleets, augmenting airborne and ground systems will enhance capabilities, reliability and flexibility, in low (LEO), middle (MEO), and geostationary earth orbits (GEO). Constellations must be optimised for different applications, requiring frequent monitoring and wide-swath imaging. Digital beam forming improvements on reception will further reduce clutter. Future lithium-ion batteries, as used by Cosmo-SkyMed, rather than Nickel-based ones, will double the battery energy per kilogram.

Against this backdrop existing large SAR system manufacturers have a head-start in experience, but significant cost reduction will require a mind-set shift in operations. Small start-up companies like Capella, building on a foundation of seasoned defence engineers, to succeed must out compete big-players such as Airbus DS and Canada’s MBDA. Capella believes its future network can match the image quality of past Pentagon 0.5-1 B$ Lacrosse satellites. We will soon know if they are right.